Long-Term Wealth Production Via Property in New York

Real estate has long been identified as one of one of the most reliable approaches for developing long-lasting wealth. In New york city, a state understood for its dynamic markets and diverse property possibilities, buying realty can offer considerable monetary returns in time. Whether you're targeting the urban sprawl of New york city City, the breathtaking vistas of Upstate New York, or the bustling suburbs, real estate in the Realm State provides countless paths to wealth development for savvy capitalists.

In this short article, we'll discover exactly how property investments in New york city can promote lasting riches, the sorts of investment approaches to take into consideration, and the factors that make New york city a prime location for real estate development.

Why Real Estate is a Powerful Device for Long-Term Wealth Development

1. Appreciation of Residential Property Worths

One of the crucial means to construct riches through realty is with the recognition of property values. With time, real estate normally increases in value, particularly in markets fresh York, where demand stays constantly high. Historically, New york city's real estate market has revealed strong appreciation, particularly in high-demand areas such as New york city City and bordering suburbs.

Urban residential properties in Manhattan, Brooklyn, and Queens, as an example, have experienced substantial gratitude over the last couple of years. In a similar way, areas like Westchester County and popular Upstate areas such as Saratoga Springs and Hudson Valley have likewise seen a consistent surge in building worths, making them attractive for long-term investments.

2. Steady Capital from Rental Revenue

Generating rental earnings is one more essential method for long-lasting riches development with realty. New York's rental market is diverse, ranging from high-end luxury apartments in the city to more economical rental homes and homes in rural and rural areas. Investors can purchase rental properties and create easy earnings with monthly rents, which, with time, can significantly add to wide range build-up.

In areas like Manhattan and Brooklyn, rental need is high as a result of restricted housing supply and a thick populace. Nevertheless, suburban and Upstate locations are additionally seeing boosted demand for rental homes as even more individuals seek inexpensive choices to city living. This pattern has just sped up since the pandemic, as remote job and lifestyle adjustments make areas like Albany, Buffalo, and Syracuse more eye-catching.

3. Tax Benefits and Incentives

Investor in New York can take advantage of many tax benefits and incentives, which can dramatically improve lasting riches production. The IRS permits real estate investors to subtract home loan passion, property taxes, devaluation, and certain operating expenses associated with taking care of the home. These reductions can decrease your gross income and increase general earnings.

In addition, funding gains from the sale of a building may be exhausted at a reduced rate than normal income, permitting capitalists to retain more of their revenues when they at some point sell.

In specific areas, New york city also provides certain tax obligation incentives for investments in chance areas or for buildings that are part of a historical preservation initiative. Leveraging these rewards can better boost the financial returns on your real estate investments.

4. Diversification and Danger Reduction

Realty supplies a substantial and secure asset class that can diversify an investment portfolio. Unlike stocks or bonds, which can be highly volatile, real estate investments are usually much more predictable and less susceptible to unexpected value changes. This stability materializes estate a crucial element in long-term wealth creation, particularly in a diverse market fresh York

Additionally, by investing in different types of residential or commercial properties-- such as residential, commercial, and mixed-use-- you can spread out danger across various real estate fields. This diversity assists reduce potential losses from downturns in any kind of one section of the market.

Top Approaches for Long-Term Property Investment in New York.

1. Buy-and-Hold Approach

The buy-and-hold approach is among the most reliable methods to build lasting riches in real estate. This approach entails buying property and keeping it for an prolonged period, enabling the residential or commercial property to appreciate in worth while generating rental revenue.

New York supplies prime chances for this strategy. As an example, investing in New York City condominiums or houses in quickly gentrifying areas, such as parts of Harlem or Bushwick, can produce substantial appreciation gradually. Likewise, acquiring rental homes in Upstate New york city, where housing rates are much more budget friendly, can offer constant cash flow while waiting on the property to appreciate.

2. Multifamily Building Investments

Investing in multifamily residential properties can be an excellent way to create consistent rental earnings and construct lasting wide range. Multifamily homes, such as duplexes, triplexes, and studio apartment structures, allow capitalists to lease several units Green Springs Capital Group within a single residential or commercial property, hence making best use of cash flow. This type of investment is specifically lucrative in urban areas where demand for rental housing is constantly high.

In New york city, multifamily residential or commercial properties in position like Brooklyn, Queens, and The Bronx are in high demand and usually produce greater rental returns due to population density and the city's consistent influx of occupants.

3. Fix-and-Flip for Strategic Wealth Building

While typically deemed a short-term technique, fix-and-flip investments can likewise contribute to long-lasting riches if done properly. Investors purchase residential or commercial properties that are undervalued or in need of renovation, improve them, and market them for a earnings. By reinvesting earnings right into larger or even more financially rewarding buildings, capitalists can gradually grow their wealth over time.

Locations beyond the primary city hubs, such as Yonkers, Staten Island, or smaller sized Upstate communities, are optimal for fix-and-flip techniques. These regions often have reduced purchase prices, and with the appropriate renovations, homes can be sold for substantial returns.

4. Business Realty Investments

For financiers looking for lasting riches creation, business realty offers a greater barrier to access however potentially bigger benefits. New york city's commercial realty market, especially in Manhattan, is just one of the biggest and most durable in the world.

Investing in commercial homes like office buildings, retail spaces, or mixed-use growths can generate long-term riches via lease contracts, residential or commercial property appreciation, and prospective tax benefits. Manhattan and Brooklyn supply high-demand locations, however chances also exist in rapidly expanding suv organization hubs like White Plains or Rochester.

Trick Factors to Consider When Purchasing New York Property

1. Market Timing and Financial Fads

Real estate markets vary, and comprehending the current market conditions is vital to making smart financial investments. New york city's real estate market is substantial and differs by area, so capitalists ought to research both neighborhood and statewide financial fads before committing to an financial investment.

2. Property Area

Place is a vital factor in any type of real estate financial investment. Quality in high-demand areas, such as Manhattan or Brooklyn, often tend to appreciate more quickly and provide greater returns, however they likewise include greater upfront expenses. On the other hand, even more cost effective markets like Buffalo or Schenectady can supply strong returns for capitalists willing to wait for appreciation in time.

3. Financing and Take advantage of

Making use of funding efficiently can boost your roi (ROI). Mortgages, lines of credit, and various other forms of utilize allow financiers to acquire bigger or several homes. Nevertheless, it's important to balance financing with cash flow to ensure you can satisfy home loan commitments while still creating profit.

Buying property in New york city offers a dependable path to long-lasting riches development, thanks to constant gratitude, strong rental demand, and tax advantages. Whether you're seeking a buy-and-hold method, investing in multifamily residential or commercial properties, or exploring business realty, New York's varied market has opportunities for both skilled financiers and newbies alike.

By comprehending regional markets, leveraging tax benefits, and diversifying your financial investments, realty in New York can be a keystone of Green Springs Capital Group lasting economic success.

Danny Tamberelli Then & Now!

Danny Tamberelli Then & Now! Michelle Pfeiffer Then & Now!

Michelle Pfeiffer Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Brandy Then & Now!

Brandy Then & Now! Marques Houston Then & Now!

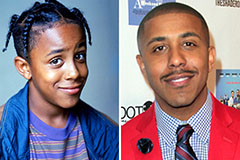

Marques Houston Then & Now!